Not for distribution to United States newswire services or for dissemination in the United States

Vancouver, British Columbia – October 30, 2023 – Fremont Gold Ltd. (FRE: TSX-V; FR2: FSE: USTDF: OTC) ("Fremont" or the "Company") is pleased to announce the closing of the first tranche of its previously announced non-brokered private placement (the "Private Placement") consisting of a total of 11,553,000 units (the "Units") at a price of $0.10 per unit for gross proceeds of $1,155,300.

Each Unit consists of one common share and one-half of one common share purchase warrant. Each whole warrant entitles the holder to purchase an additional common share at a price of $0.17 per share for a period of 24 months following closing of the Private Placement.

The Company intends to use the net proceeds of the Private Placement for general working capital, to undertake an initial drill campaign at the Company's Vardenis project located in central Armenia, advance the Urasar project and to repay $100,000 of a loan in the amount of $200,000 cash provided by Dennis Moore (the President and CEO of the Company).

The securities issued pursuant to the Offering will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an exemption from the registration requirements.

All securities issued in connection with the Private Placement are subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation and the policies of the TSX Venture Exchange, pursuant to which they may not be sold or transferred until February 28, 2024.

The TSX Venture Exchange's final acceptance of the Private Placement is conditional upon the Company satisfying the filing requirements as outlined in TSX Venture Exchange Policy 4.1, 'Private Placements'.

Pursuant to Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101") the Company advises that certain directors and officers of the Company participated in the Private Placement. This participation, as well as the proposed loan repayment to Dennis Moore constitute "related party transactions" under MI 61-101. The Company will be relying on the exemptions from the formal valuation requirements contained in section 5.5(b) of MI 61-101 and the minority shareholder approval requirements contained in section 5.7(1) (a) of MI 61-101, as the Company is not listed on specified markets and the fair market value of the insider participation in the Private Placement and the loan repayment to Mr. Moore does not exceed 25% of the Company's market capitalization, as determined in accordance with MI 61-101.

Approval of the Vardenis Definitive Agreement

The Company is pleased to announce that the TSX Venture Exchange has approved the terms of the Vardenis definitive agreement (see news release of June 6, 2023). The definitive agreement provides the Company with an option to acquire up to a 100% interest in Mendia Resources Corp. ("Mendia"), an Armenian corporation, with Mendia's sole shareholder, an Armenian individual (the "Optionor"). Mendia holds the exploration license over the Vardenis copper-gold project in central Armenia. The option agreement provides for a series of staged cash payments, share issuances and work commitments over 4.5 years to earn up to 100% of Mendia. The cash and share grants total US$350,000 and 2.2M Fremont common shares, respectively, to earn up to 90% of Mendia. The work commitments consist of (i) exploration surveys and mapping, construction of drill roads, and 2,500 meters of diamond drilling by December 2024; (ii) a further 5,000 meters of diamond drilling by June 2026; and (iii) a preliminary economic assessment level study by December 2027.

On exercise of the option to acquire 90% of Mendia, the Company will have a further option to acquire the remaining 10% of Mendia for a maximum of US$3,500,000 in cash, a maximum of 7,000,000 common shares, or a combination thereof. See a complete description of the option terms and the Vardenis property in the news release dated May 9, 2023.

Mendia and the Optionor are arm's length parties to the Company. There were no finder fees paid in connection with the transaction.

Pursuant to the TSX Venture Exchange's conditional approval, the Company will file a NI-43-101 compliant report on the Vardenis project no later than November 30, 2023.

Vardenis Exploration

The Company is pleased to announce that it has completed the analysis of historical geochemical and spectral data collected by Dundee Precious Metals ("Dundee") augmented by 720 additional samples for spectral analysis collected by the Company in July this year (see news release dated June 6, 2023). This desktop study was followed up by detailed alteration mapping over areas of the project where the combination of geochemical and spectral data suggests the possibility of porphyry-style mineralization. The mapping work allowed the definition of the Razmik Cu-Mo porphyry target, which is the current focus of the exploration work at Vardenis and is being drill-tested for the first time.

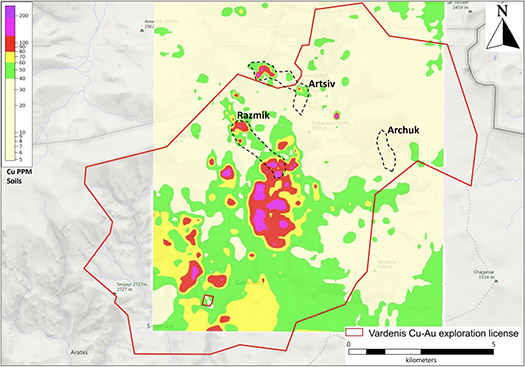

Figure 1. Location of the Razmik Cu-Mo porphyry target and additional targets within the large historical Cu soil anomaly

Razmik Porphyry Target

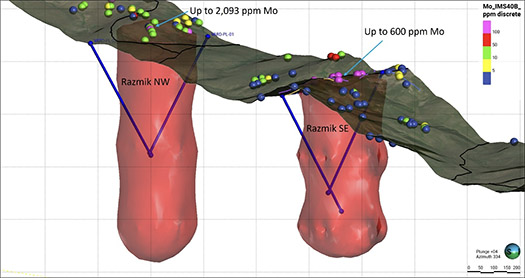

The Razmik Cu-Mo Porphyry target is likely the center of the entire Vardenis alteration system and for now is the main exploration target within the property. The system is characterized by a large zone of quartz-sericite alteration with two centers of B and D-type veinlets (Razmik SE and Razmik NW). The quartz-sericite-chlorite core is surrounded by extensive propylitic alteration on its south, east, and west margins and by preserved advanced argillic on the north and northwest. The northwest striking sericite to chlorite-sericite alteration zone is approximately 2.1 km by 0.5 km and represents the core of the porphyry system.

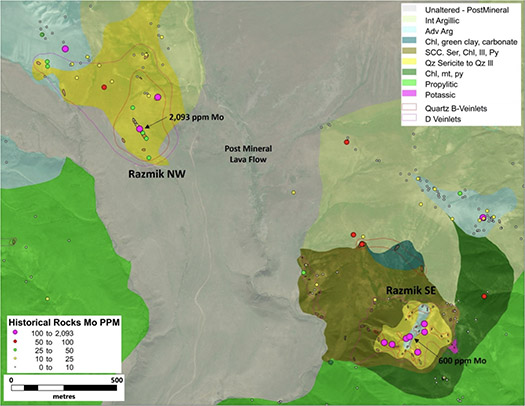

Figure 2. Alteration, veinlets, and geochemistry overview of the Razmik porphyry.

Razmik SE is approximately 450 m by 300 m of multiple outcropping zones of B veinlets surrounded by D veinlets. Historical sampling of these veinlets shows Mo values up to 600 ppm and Cu up to 0.14% Cu.

Razmik NW comprises a core of B veinlets measuring 430 m by 230 m surrounded by a zone of pyrite veinlets of up to 700 m by 400 m. Historical sampling shows Mo values up to 2,093 ppm (being the highest Mo value on the property), and 442 ppm Cu. Razmik NW and SE are separated by zones of chlorite-sericite clay alteration and also by a post-mineral lava flow, opening the possibility of additional porphyry mineralization below the post-mineral cover.

Figure 2 shows a summary map of alteration and veinlets from the Razmik porphyry target including both veinlet centers, Razmik SE and Razmik NW. The sericite to chlorite-sericite that contains the two porphyry centers transitions to propylitic alteration (chlorite, epidote, calcite, albite, pyrite, magnetite) to the south and southwest, to advanced argillic (quartz-dickite, quartz-kaolinite) to the northwest, and to intermediate argillic (illite, smectite, pyrite) to the north and northeast. A small outcrop with remnants of K-feldspar alteration, quartz and magnetite veinlets was observed on the eastern margin of the Razmik SE sericitic zone, and a narrow zone of chlorite-magnetite marks the boundary between sericitic and propylitic alteration in this area.

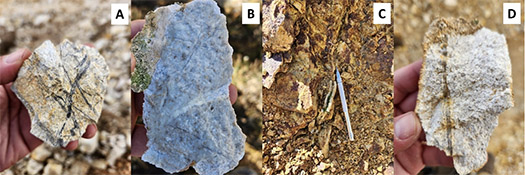

Figure 3. Examples of porphyry quartz veinlets from Razmik SE. A shows dark, narrow and sinuous, possibly A-type veinlets while B, C, and D show more rectilinear veins with a central suture typical of B-type veinlets.

Drill Targets

Combining the historical work from Dundee with the recent field mapping reveals that the most prospective area for porphyry copper-moly mineralization is the large Razmik copper anomaly. With its two centers of B and D-veinlets and high values of Mo in historical samples, Razmik is a target that could host a significantly large Cu-Mo porphyry deposit.

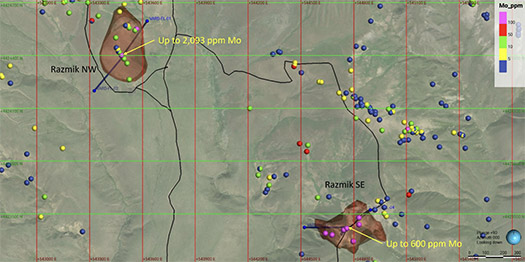

Both zones of Razmik are accessible by road and therefore easy to be drill tested. A preliminary drill program is planned for the Razmik porphyry target (Figure 4) comprising a minimum of two diamond drill holes.

Drill Program Commences

An Atlas Copco CS14 drill rig capable of drilling up to 1,000 meters depth has been mobilized to site. Initial drill holes will investigate the thickness of the sericitic alteration and the transition from Mo>Cu to dominant copper (Figures 4 and 5). Final depths will depend on alteration changes and observed mineralization as the holes advance.

Figure 4. Location of proposed holes for Razmik NW and Razmik SE, illustrating the envelope of quartz veinlets on the surface and Mo anomaly as well as existing road access.

Figure 5. Porphyry copper model/animation showing proposed drill holes at Razmik SE and NW, Vardenis property.

Dennis Moore, Fremont's President and CEO states, "It has been an exciting two years putting our Armenian portfolio together. We now have two very promising projects in Vardenis and Urasar. It was not easy starting in a new jurisdiction, but management recognized the enormous opportunities in this part of the Tethyan belt and believes the Company's shareholders will be rewarded for their patience. We are thrilled that the drill rig will be turning at Vardenis and that we will be able to carry out our initial mapping and surveying at Urasar before winter sets in."

Early warning report

William Richard Brown of Vancouver, British Columbia, Canada, did not acquire or dispose of any securities of the Company to trigger the requirement to file an early warning report. Immediately prior to the completion of the Private Placement, the Company had 25,869,097 common shares issued and outstanding and Mr. Brown owned and/or had control over 3,687,500 common shares of the Company, representing approximately 14.25% of the issued and outstanding common shares of the Company at such time, on an undiluted basis. Pursuant to the Private Placement, the Company issued 11,553,000 common shares and the Company now has 37,422,097 common shares issued and outstanding. Mr. Brown owns 3,687,500 common shares of the Company, representing approximately 9.85% of the total issued and outstanding common shares of the Company as at October 27, 2023. This represents an approximate 4.40% change in Mr. Brown's ownership and/or control of common shares of the Company on a non-diluted basis. The securities owned and/or controlled by Mr. Brown are held for investment purposes. Mr. Brown may, depending on market and other conditions, increase or decrease his ownership of the Company's securities, whether in the open market, by privately negotiated agreements or otherwise, subject to a number of factors, including general market conditions and other available investment and business opportunities.

The disclosure above with respect to Mr. Brown's shareholdings contained in this news release is made pursuant to Multilateral Instrument 62-104 – Take-Over Bids and Issuer Bids and a report respecting the above acquisition will be filed with the applicable securities commissions using the System of Electronic Document Analysis and Retrieval (SEDAR+) website at www.sedarplus.ca.

Qualified Person

The scientific and technical content of this news release was reviewed by Dennis Moore, Fremont's President, CEO and interim Chairman, who is a Qualified Person as defined by National Instrument 43-101.

About Fremont Gold

Fremont's mine-finding management team has assembled a portfolio of high-quality copper-gold projects within the central Tethyan Belt of Armenia with the intention of making world-class size discoveries. These projects include the Vardenis copper-gold property located in central Armenia and the Urasar District gold project in northern Armenia. Other opportunities in the belt are being evaluated. The Company also holds three substantial gold properties in Nevada and is in the process of vending these assets.

On behalf of the Board of Directors,

Dennis Moore

President and CEO, interim Chairman

Telephone: +351 9250 62196

Email: dennis@fremontgold.net

www.fremontgold.net

https://twitter.com/GoldFremont

https://www.linkedin.com/company/fremont-gold/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward looking statements

This news release contains forward-looking statements. All statements other than statements of historical fact included in this news release, including, without limitation, statements regarding the use of proceeds from the private placement, the drill program on the Vardenis project and work on the Urasar project, are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements including in respect of planned exploration activity at each of Vardenis and Urasar. Important factors that could cause actual results to differ materially from the Company's expectations including the risks detailed from time to time in the filings made by the Company with securities regulations. The reader is cautioned not to place undue reliance on any forward-looking information. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by Canadian securities law.